ATTENTION! At 00:00 the MTIBU database will be updated. Please start concluding the contract after 00:00

27.04.2017

2105

Israeli insurtech startup Lemonade, which specializes in online property insurance, announced that German insurance group Allianz has become its strategic investor.

The company did not disclose the amount of the investment or the market value on which the investment was based.

Lemonade was founded almost 2 years ago and has so far received more than $60 million from various investment funds. The startup has 35 employees. In September 2016, the company began operating as an insurer in New York and Illinois.

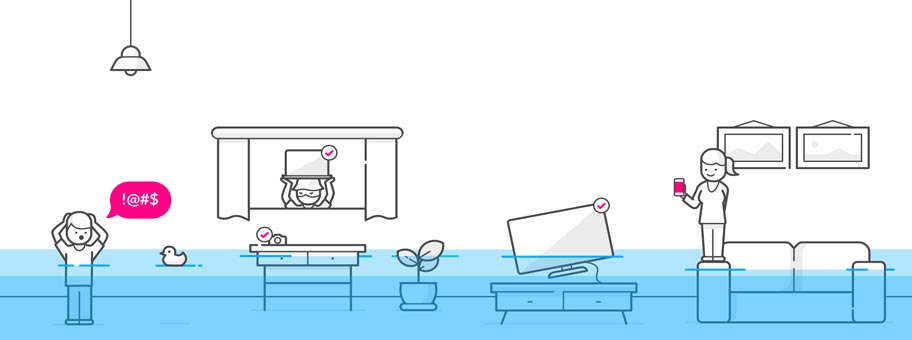

The startup offers apartment insurance for owners and renters, starting at $35 per month for owners and $5 for renters. The entire operation, from the issuance of a policy to the submission of an application for insurance compensation, is carried out online or via a mobile application. The platform operates on the basis of bots and algorithms, which allows processing a payment application without human intervention. Compensation is paid within 3 seconds.

Lemonade is considered one of the symbols of the technological revolution in the insurance sector, experts say. The principle of its operation differs from the principles of operation of traditional insurers: 20% of the premium is a payment for services. In addition, when purchasing a policy, the client is asked to indicate which organization to transfer the money remaining at the end of the year (minus the payment for services and applications for compensation).

Some experts believe that such startups pose a threat to traditional insurance companies, especially in the field of property insurance. They offer a completely new type of service, devoid of bureaucracy and with a speed of compensation payments unprecedented in traditional companies. Therefore, it is not surprising that «Allianz» decided to become a strategic investor in «Lemonade».

Munich Re and AXA are also not far behind and are cooperating with insurtech startups.

Source: Forinsurer