ATTENTION! At 00:00 the MTIBU database will be updated. Please start concluding the contract after 00:00

13.03.2018

2189

Read the original language

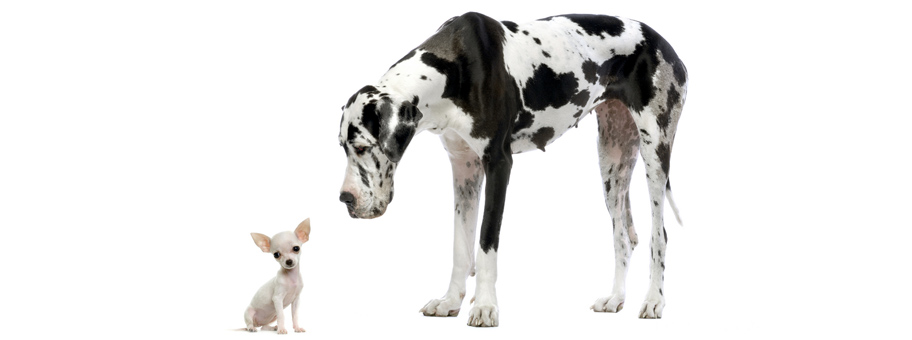

Let's talk about "small" in insurance – small insurance companies. Are small companies good or evil? Are they good or bad? Are they relics of the crisis or the seeds of a new economy? Let's try to understand these questions.

Companies come in different types: large and small. In order to compare companies by size, it is necessary to establish metrics – certain numerical characteristics by which we can determine whether one company is larger and another is smaller. Typically, metrics chosen include company capital, number of employees, and payment volume. Some studies consider customer base characteristics: the number of clients and their geographical distribution. Other researchers analyze the company's organizational structure and management structure. Why, with such a wide variety of approaches to defining company size, isn't there confusion about who is large and who is small? The fact is that metrics are highly correlated. A company that is small by some metrics is usually small by others as well. Therefore, an intuitive understanding of "small" is sufficient for understanding general trends.

Small is not just about size, but also about business philosophy. The world of "small" is diverse. Among small insurance companies, there are also weak, unprofessional companies that are of no interest to consumers. Yes, that's a fact. But such companies also exist among large ones. In addition to companies forced to shrink under market pressure and unfavorable circumstances, there are others that consciously choose the "small" form factor. Small size has its advantages. Traditionally, these include:

Sensitivity. A small insurer can offer clients something a large one cannot: personal attention. Personalized service is the foundation of small insurance companies. At a large company, you're one of thousands of clients; at a small one, you're "the only one." Small companies often outperform large ones in customer satisfaction.

Cost-effectiveness. Because small insurers spend less on marketing and advertising and have lower overhead costs, they can afford to offer lower rates.

Dynamicness. Small companies find it much easier to innovate and adapt to market demands.

Competence. Small insurers tend to be more specialized, and within their area of expertise, they can be more competent than their larger, more generalist counterparts.

Building your business by leveraging these advantages is a wise and pragmatic strategy that deserves respect.

Small doesn't mean loser.

The latest trend in the insurance market is Insurtech. Google suggests that Insurtech is the implementation of innovative solutions designed to maximize the effectiveness of new technologies in the insurance market. Insurtech is changing approaches to insurance through the application of modern technologies such as artificial intelligence, telematics, big data, blockchain, and many others. Thanks to this, Insurtech companies can offer their clients a more affordable, high-quality, and customized product, creating serious competition for traditional insurers.

The advantages of Insurtech are widely understood. However, large and small insurers have different attitudes toward new technologies.

Largest companies are extremely cautious when it comes to Insurtech innovations. However, growing consumer interest in new technologies is forcing large insurers to begin studying them and investing heavily in them.

Small companies are more dynamic in implementing technological innovations and often act as Insurtech startups. However, a serious challenge for small insurers in this area is the limited funds they can afford to invest in these developments.

Given this situation in the insurance market, it's appropriate to recall Rupert Murdoch's famous phrase: "Big no longer beats small." The time has come when the fast beats the slow."

We are experiencing a cult of greatness for large companies.

Consumers often prefer policies from large companies over those from small ones. Professionals consider working for a large company more prestigious. The regulator is trying to purge the market of small companies altogether.

We are turning the insurance market into a market for large companies. We don't perceive small companies as serious market participants. We view "small" companies as hopeless.

Why? Large insurance companies spend millions on advertising and marketing. Large ones are huge agency networks. Large ones are a powerful lobby. The "small" ones lack all this.

That's why we know the large insurers by name. Thanks to advertising, we know they are the most reliable and safe. They have the most innovative discount and bonus systems. They work for us 7 days a week, 24 hours a day. Their offices are located everywhere.

What do we know about small companies? How many small companies are there on the market? What is their efficiency? How reliable are they? Such studies don't exist. Experts aren't interested in this, and government officials aren't interested.

There are many small companies. Their market share is small. But they operate more efficiently than large companies. Customer satisfaction with "small" companies is higher than with "large" ones. Moreover, their existence helps foster competition and improve the quality of insurance services.

Small insurance companies are small businesses. And like small businesses in general, they require special government support. They should have their own system of regulations and a special simplified accounting system, as is done in other areas of small business.

Change begins with understanding. Let's acknowledge that "small insurance" exists. It's diverse, interesting, and promising. We shouldn't dismiss it.

The insurance market cannot be strong without large companies. But without small companies, it will become dull, cold, and inert. Let's make our insurance strong, vibrant and diverse!

Dzherelo: Association "Insurance Business"

Author: Volodymyr Babko (Head of the Board of the IC "Mir")